|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding the Different Types of Home Refinance LoansRefinancing a home loan can be a strategic financial move to lower monthly payments or access equity. However, it's crucial to understand the various options available. This guide explores the different types of home refinance loans and their benefits. 1. Rate-and-Term RefinanceThe rate-and-term refinance is one of the most common types of refinancing options. It focuses on changing the interest rate and loan term without altering the principal amount. Benefits

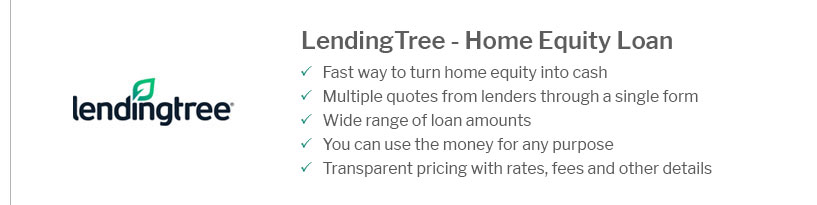

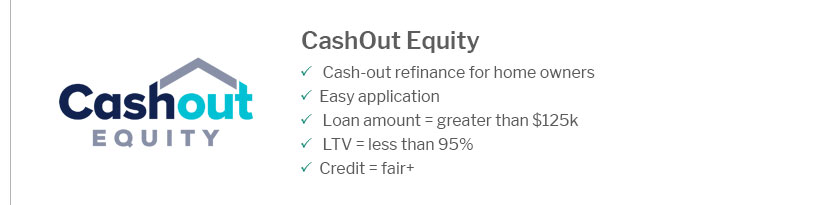

To explore the best current refinance rates, it's advisable to compare different lenders. 2. Cash-Out RefinanceWith a cash-out refinance, you can borrow more than you owe on your home and take the difference in cash. This is ideal for homeowners looking to leverage their home equity. Benefits

3. Streamline RefinanceThis option is designed for homeowners with government-backed loans such as FHA or VA loans, offering a simplified process. Benefits

Homeowners in specific regions can benefit from specialized lenders. For instance, if you live in Florida, you might want to check out the best refinance companies in florida for tailored options. 4. No-Closing-Cost RefinanceThis refinancing option allows homeowners to refinance without paying upfront closing costs by incorporating them into the loan balance. Benefits

FAQsWhat is the main advantage of a rate-and-term refinance?The primary advantage is the potential for a lower interest rate, which can significantly reduce monthly payments. How does a cash-out refinance differ from a home equity loan?A cash-out refinance replaces your existing mortgage with a new one and provides cash, while a home equity loan is a separate loan alongside your existing mortgage. Are streamline refinances available for all loan types?No, streamline refinances are typically available for government-backed loans like FHA and VA loans, offering simplified processes and reduced costs. https://www.lendingtree.com/home/refinance/options-refinancing-home/

Types of mortgage refinances at a glance ; FHA streamline refinance, Change the terms of your FHA loan with less paperwork and without a home appraisal ; VA ... https://www.zillow.com/learn/types-of-refinance/

7 Types of Refinance Loans - Rate-and-term refinance - Cash-out refinance - Streamline refinance - Cash-in refinance - No-closing cost refinance. https://finance.yahoo.com/personal-finance/home-refinance-options-173007768.html

These allow you to replace your old loan with a new one that has a different rate, term length, or loan type. How many types of refinances are ...

|

|---|